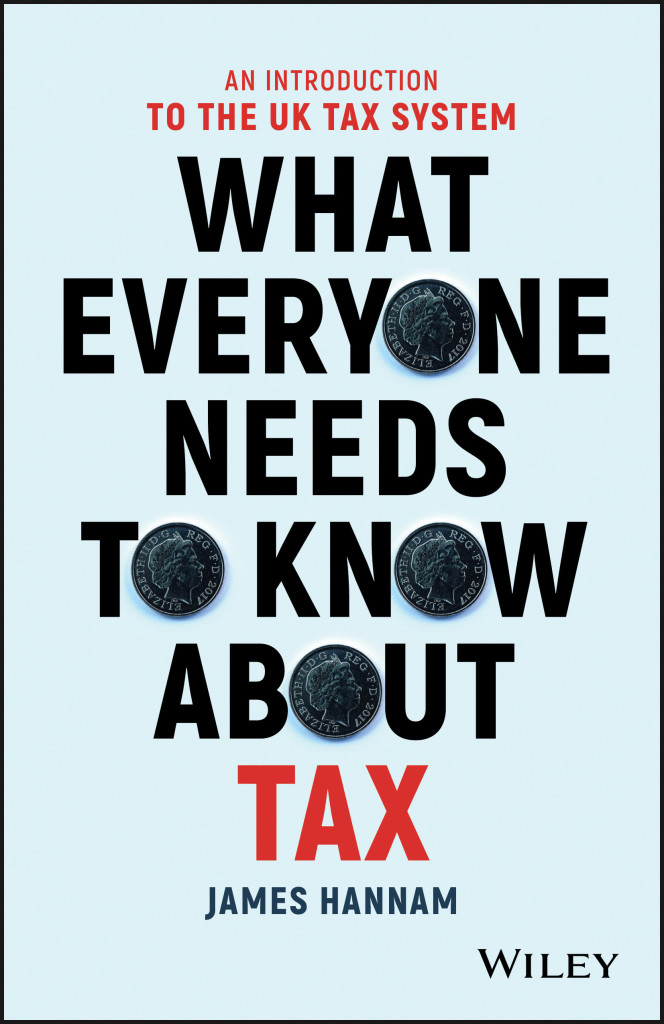

What Everyone Needs to Know about Tax: An Introduction to the UK Tax System By James Hannam immediately caught my eye. Sure I have an interest in finance and the workings of the society that we live in, but I have always been interested in tax. Now tax is a good thing; it is how society runs. No tax and no NHS, education or public services at all. But are we overtaxed? I thought that most people are overtaxed before, after reading this book, even more so. As the book points out there is income tax, employee national insurance (of various classes), employer national insurance, VAT, stamp duty, council tax, inheritance tax. The list just goes on. We are overtaxed and the government tries to make some of these taxes as invisible as possible. Did you know that someone on a salary of £26,000 pays almost £8000 in tax a year? Or that the top 0.05% of the UK population pay over a quarter of all income tax? The top 10% of earners pay over half the income tax, which is about 100 billion a year. Just 5% of the population pay more in income tax than the rest of the population put together. How much do you have to earn to be in this top 5%? Just over £50,000 a year. Another great section goes on about how taxes cause the poverty trap that people on benefits can get caught in when they try to get off benefits, they can essentially get taxed at 90%. More than the richest in society. Depressing? Yes. Fair? No. The book also has a great section on pensions versus ISAs. I have always been wary of pensions and the book helped clarify my thoughts.The book is full of great facts like that by a man who really knows his stuff. The book is chock full of essential information and interesting fact. I can highly recommend it to anyone who wants to get a grip of the complex UK tax system.Due to be published by Wiley, 23rd March 2017

£19.99, Paperback and e-bookISBN: 9781119375784“You pay a lot of tax. Of course, you know that. But I bet you don’t know just how much you pay, or all the ways the government has to extract the cash from you.” – James HannamIn his new book, What Everyone Needs to Know about Tax, James Hannam takes look at the UK tax system and provides non-specialist readers with an easy-to-understand explanation of tax and tax policy to show them just how much they pay, how the money is collected and how tax affects ordinary people every day.With no accounting or legal knowledge required, it contains practical case studies to illustrate how tax functions in the real world, for example: how the VAT on a plumber’s bill all adds up; why fraudsters made a movie to throw HMRC off their scent; how a wealthy couple can pay minimal tax on a six-figure income; and the way tracing the money you paid for your iPad sheds light why the EU is demanding Apple pay billions extra in tax.Written in a conversational style, What Everyone Needs to Know about Tax gives readers a real-world look at how tax works. In it they will:

- Learn about the many ways that the tax system separates us from our money

- Discover how Brexit could change the way we pay taxes

- Understand how changing tax policy affects people’s everyday lives

- See through the rhetoric from politicians and the media surrounding tax controversies

The system’s underlying logic is illustrated through three ‘golden rules’ that explain many of the UK tax regime’s oddities:

- Lots of small taxes together add up to make big tax bills – “The point of all these taxes is to spread the pain so we notice it less.”

- No matter what name is on the bill, all taxes are ultimately suffered by human beings – taxes levied on manufacturers are passed on to the consumer through a higher price for the product

- Taxes are kept as invisible as possible – “Since we all hate paying taxes, the government has perfected the art of ensuring that we rarely have to hand over the money ourselves. Most taxes are paid by businesses on our behalf.”

With tax, there are no easy answers. No one enjoys paying them, but without them, the government would shut down.Whether readers are self-employed, have a general interest in the way the UK tax system works, are a finance or tax professional, or students wanting to understand more about taxation in a break from traditionally dry text books, What Everyone Needs to Know about Tax gives them the background and foundational knowledge they need to be a well-informed taxpayer.What Everyone Needs to Know about Tax will be published on 23rd March 2017 and will be available wherever books and ebooks are sold.

JAMES HANNAM, PHD, has spent twenty years advising clients on every aspect of the UK tax regime while working for firms including EY, Freshfields, and KPMG.